Anti-Money Laundering

Simplify your operations and improve your financial security from one place.

Simplify your operations and improve your financial security from one place.

Protect your business and your revenue with our state-of-the-art solutions. Prevent money laundering, manage your customer identification program and automate risk assessment with our full suite of investigative tools.

Protect your business and your revenue with our state-of-the-art solutions. Prevent money laundering, manage your customer identification program and automate risk assessment with our full suite of investigative tools.

Risk management is more important than ever

Risk management is more important than ever

Latan is estimated to have more than 256 billion transactions by 2023. AML regulations require thorough scrutiny of every transaction.

Don't get left behind, protect your business with our solution.

Latan is estimated to have more than 256 billion transactions by 2023. AML regulations require thorough scrutiny of every transaction.

Don't get left behind, protect your business with our solution.

$8.1

$8.1

billon annually

billon annually

In fines due to improper handling of AML in 2023

In fines due to improper handling of AML in 2023

$8.1

billon annually

In fines due to improper handling of AML in 2023

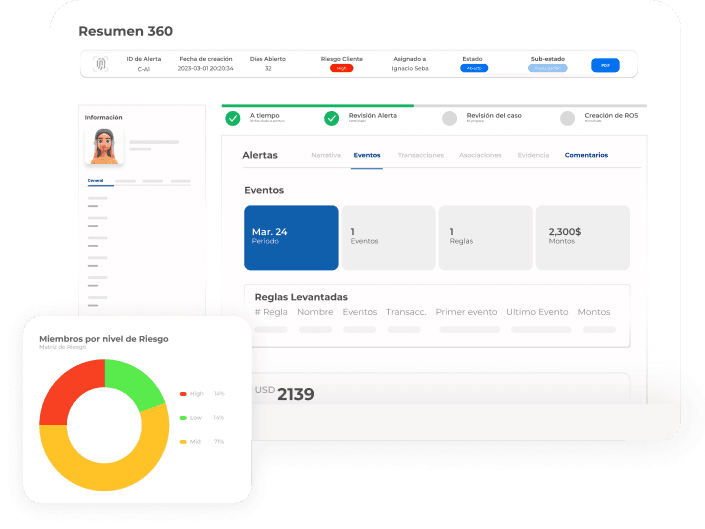

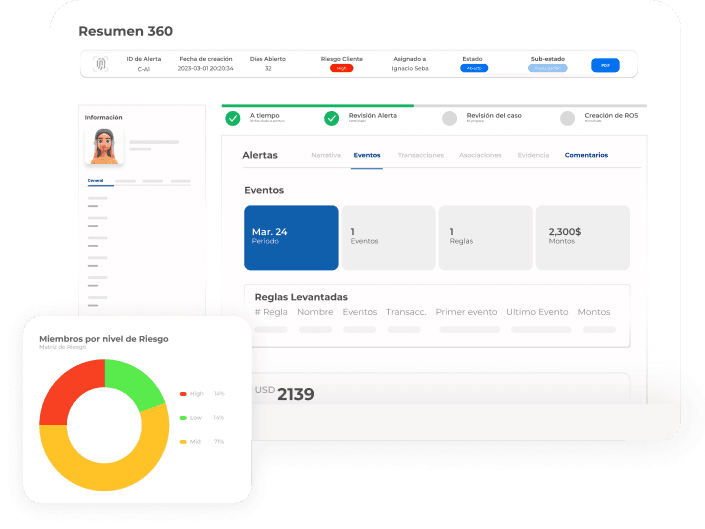

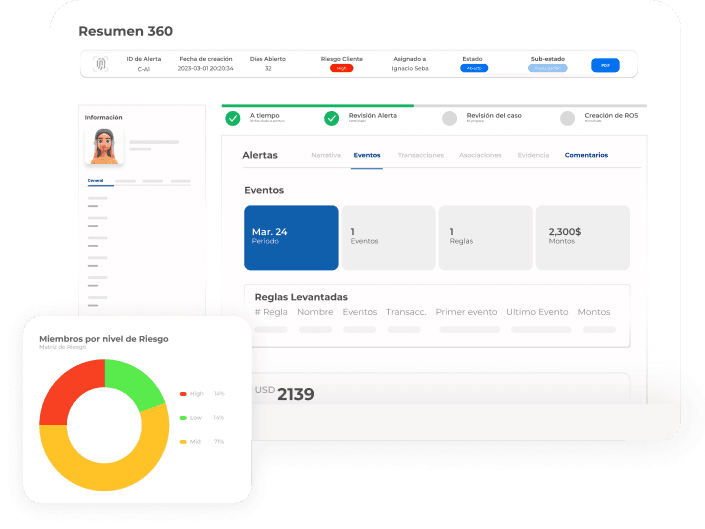

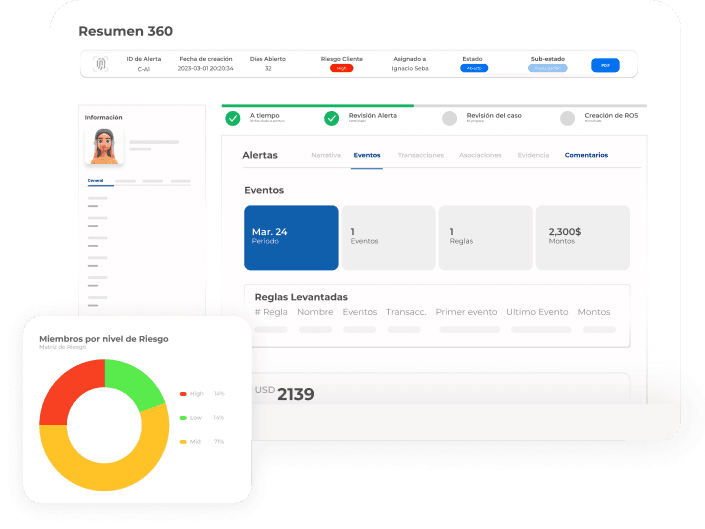

All your data on a single platform

All your data on a single platform

Unify your risk management and optimize your operations.

Unify your risk management and optimize your operations.

We protect your business

Our solutions go beyond standard compliance, offering state-of-the-art tools to optimize your operations.

Know your customer in depth

Perform comprehensive KYC, KYB and EDD, including document verification, behavioral biometrics and continuous monitoring.

Customized risk matrices

Create detailed risk profiles for each customer, integrating multiple sources of information.

Artificial intelligence in the service

of compliance

Unlock the potential of your data with our artificial intelligence technology, gaining valuable insights in real time.

Guardian Eyes

360° personalized monitoring for each customer, thanks to our cutting-edge AI.

Kevin AI

Your virtual assistant for compliance, always up-to-date with the latest regulations

Improve and automate case management

Customer Risk Management

Anticipate risks before they occur.

With Customer Risk, companies can proactively identify high-risk customers, enabling early intervention and avoiding significant financial losses. Our solution, powered by artificial intelligence, analyzes a broad set of data to detect suspicious patterns and predict future behavior.

Real-Time Screening

Optimize your compliance processes.

Anticipate risks before they occur.

With our real-time screening system, you can be sure that your business operations comply with the most stringent international regulations. Our database is constantly updated with the latest sanctions lists, ensuring complete global coverage.

Improve and automate case management

Customer Risk Management

Anticipate risks before they occur.

With Customer Risk, companies can proactively identify high-risk customers, enabling early intervention and avoiding significant financial losses. Our solution, powered by artificial intelligence, analyzes a broad set of data to detect suspicious patterns and predict future behavior.

Real-Time Screening

Optimize your compliance processes.

Anticipate risks before they occur.

With our real-time screening system, you can be sure that your business operations comply with the most stringent international regulations. Our database is constantly updated with the latest sanctions lists, ensuring complete global coverage.

Risk management is more important than ever

Latan is estimated to have more than 256 billion transactions by 2023. AML regulations require thorough scrutiny of every transaction.

Don't get left behind, protect your business with our solution.

$8.1

billon annually

In fines due to improper handling of AML in 2023

Are you ready?

Risk management is more important than ever

Latan is estimated to have more than 256 billion transactions by 2023. AML regulations require thorough scrutiny of every transaction.

Don't get left behind, protect your business with our solution.

$8.1

billon annually

In fines due to improper handling of AML in 2023

Are you ready?

Anti-Money Laundering

Simplify your operations and improve your financial security from one place.

Protect your business and your revenue with our state-of-the-art solutions. Prevent money laundering, manage your customer identification program and automate risk assessment with our full suite of investigative tools.

Anti-Money Laundering

Simplify your operations and improve your financial security from one place.

Protect your business and your revenue with our state-of-the-art solutions. Prevent money laundering, manage your customer identification program and automate risk assessment with our full suite of investigative tools.

We protect your business

Our solutions go beyond standard compliance, offering state-of-the-art tools to optimize your operations.

Know your customer in depth

Perform comprehensive KYC, KYB and EDD, including document verification, behavioral biometrics and continuous monitoring.

Customized risk matrices

Create detailed risk profiles for each customer, integrating multiple sources of information.

Artificial intelligence in the service of compliance

Unlock the potential of your data with our artificial intelligence technology, gaining valuable insights in real time.

Guardian Eyes

360° personalized monitoring for each customer, thanks to our cutting-edge AI.

Kevin AI

Your virtual assistant for compliance, always up-to-date with the latest regulations

All your data on a single platform

Unify your risk management and optimize your operations.

Improve and automate case management

Customer Risk Management

Anticipate risks before they occur.

With Customer Risk, companies can proactively identify high-risk customers, enabling early intervention and avoiding significant financial losses. Our solution, powered by artificial intelligence, analyzes a broad set of data to detect suspicious patterns and predict future behavior.

Real-Time Screening

Optimize your compliance processes

With our real-time screening system, you can be sure that your business operations comply with the most stringent international regulations. Our database is constantly updated with the latest sanctions lists, ensuring complete global coverage.

Improve and automate case management

Customer Risk Management

Anticipate risks before they occur.

With Customer Risk, companies can proactively identify high-risk customers, enabling early intervention and avoiding significant financial losses. Our solution, powered by artificial intelligence, analyzes a broad set of data to detect suspicious patterns and predict future behavior.

Real-Time Screening

Optimize your compliance processes

With our real-time screening system, you can be sure that your business operations comply with the most stringent international regulations. Our database is constantly updated with the latest sanctions lists, ensuring complete global coverage.